Special Focus on Entertainment Indicates Shift in Consumer Behavior With Implications for Movie Industry

LOS ANGELES, May 7 – Over half of the 23,800 Americans polled by Screen Engine/ASI’s Tracktion Entertainment Tracker between March 7, 2020- April 17, 2020 wonder when it will be truly safe to return to being in large gatherings, with women (60%) more concerned than men (47%) with the highest concern among females 50 and over (66%). Not only are they apprehensive about COVID-19, they are also worried about finances. A third of the respondents (32%) feel that they will be spending less.

“With so many people guessing what the mood of the country is like, we decided to find out, taking advantage of our on-going research survey to pose questions about how Americans are feeling, what they are doing during lockdown and what they think their world will look like moving forward,” said Kevin Goetz, CEO, Screen Engine/ASI. “Over the last six weeks we’ve seen growing concern about both health and finances, fear about safety in large crowds and as it relates to the film industry, a significant shift in desire to go to the movies, even among avid moviegoers.”

For the week ending April 17, 53% of all Americans surveyed said they are very concerned about the coronavirus, with another 35% somewhat so, up 100% from when the question was asked six weeks earlier. Only 4% say they are not concerned at all. What is at the forefront for Americans is the health of family and friends (66%) and staying healthy (60%). Almost as compelling as health is worry about the general state of the economy (60%). While there are regional differences, the most interesting is gender, with women more apprehensive than men across the board.

What comes next? Getting out is a top priority, although going to a movie theater is not a driver

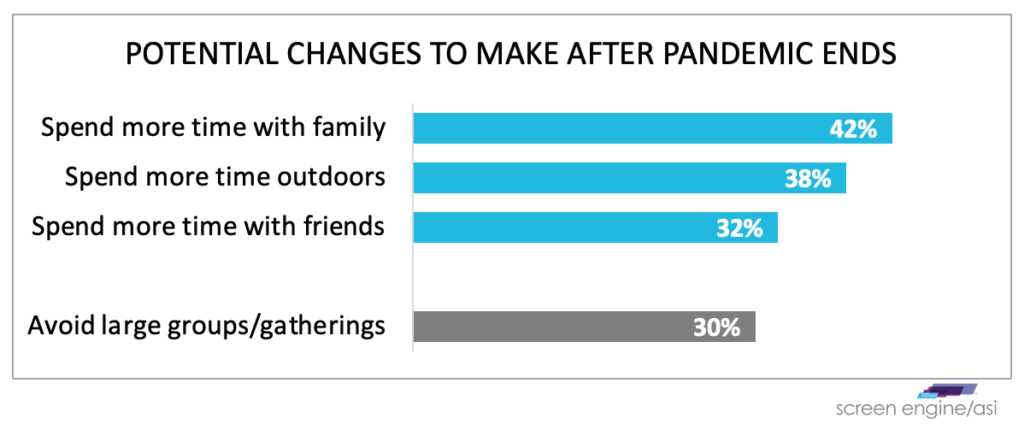

As Americans begin to consider life after lockdown, activities that top the list of things they want to return to are spending time with family (42%) and friends (32%), and spending more time outdoors (38%). Activities to do first are going out to a restaurant or bar (33%), and going on a vacation (21%).

Americans are in no hurry to go back to movie theaters, with 17% adopting a wait-and-see attitude, 31% saying they will wait until the pandemic is over and 12% say that they will never go back. An additional 23% say they will return only if there is something that they really want to see. This response also skewed male. 11% say that they will go back to the theater only if they feel fully secure that the theaters have executed all the safety and health procedures to make the auditoriums safe.

Even among the most frequent moviegoers, those who go six or more times a year, 15% say they will go back only when their safety is assured, 19% say that they will wait and see and 20% say that they will wait until the pandemic is over.

In terms of projecting audience, there are only 8% committed to going back to movie theaters as soon as they open. When looked at by those who are the most frequent moviegoers, 14% say that they will return right away, and these are mostly male and younger. They live more in the South and the West than in the Northeast and the Midwest. At the other end of the spectrum, females 35 and over are the least likely to return to the theaters until they know that they and their families will be safe.

A lifestyle pivot in the making

Habits have changed. The small screen has proved to be satisfactory. 46% (solidifying at 50% among avid moviegoers) have a desire to see new movies at home. This is in addition to the 33% who want to watch movies that they have already seen before. Suggested by the findings is that people are ready for “day and date” release, and supports decisions of some studios to release their new content for in-home viewing. The proportion interested in watching movies they have not seen rises to 55% among individuals planning to entirely stop seeing movies in a theater.

“The challenge for movie makers is to get a handle on the pulse of the nation and the world as to which movies might draw people back into theaters, and what promises they can help the theater chains fulfill,” said Goetz. “A major joint effort has to be launched to assuage the fear of being in crowds. Further, both distributors and exhibitors have to partner to make safety an authentic priority if the movie business as we have known it will survive this crisis.”

Gauging the psychological impact

Individuals do express hopefulness, however, with close to half (46%) feeling that their lives will return to what they were before the pandemic, a prevalent opinion among conservatives (50%) and those living in the South (49%). The remaining quarters are split between impressions that the change on them will be positive or negative. Those thinking positively are individuals for whom the virus might not have had a direct impact, who tend to be younger.

As well, there is perception of positive change post-pandemic among those who have suffered the strongest consequences and hope to come out the other side, including African-Americans (44%) and Hispanics (39%), those having been diagnosed with the virus (38%) and individuals with direct connection to working on the front lines as health care professionals, first responders, or essential workers (33%)

Conversely, those most expectant of a negative shift in life are liberals at 34% (compared to 27% among moderates and 20% among conservatives), and Americans with on-going high anxiety about the virus in general (32%).

Screen Engine/ASI will continue to monitor consumer response to COVID-19 on a weekly basis.

About Screen Engine/ASI

Screen Engine/ASI, headquartered in Century City, CA, is one of the top three data acquisition and analytics companies serving the international entertainment industry. SE/ASI conducts movie test screenings, creative advertising testing, in-theater exit polling, television program and promo testing, content lifecycle research, pre-release tracking of movie, TV & home entertainment titles, and a variety of digital entertainment research products through online, central site, and in-field intercept methods. SE/ASI is a full-service research and information agency and consultancy working with major Studios, television broadcasters, cable networks, streaming services, production companies and other leaders in digital entertainment to better identify and leverage opportunity and assess and manage risk.

###